Embark on Your Wealth Building Journey

With a 403b Savings Plan

THERE ARE TWO TYPES OF SAVERS!

Those who Spend First

Then Try to Save!

Those who Pay Themselves First

Then Spend!

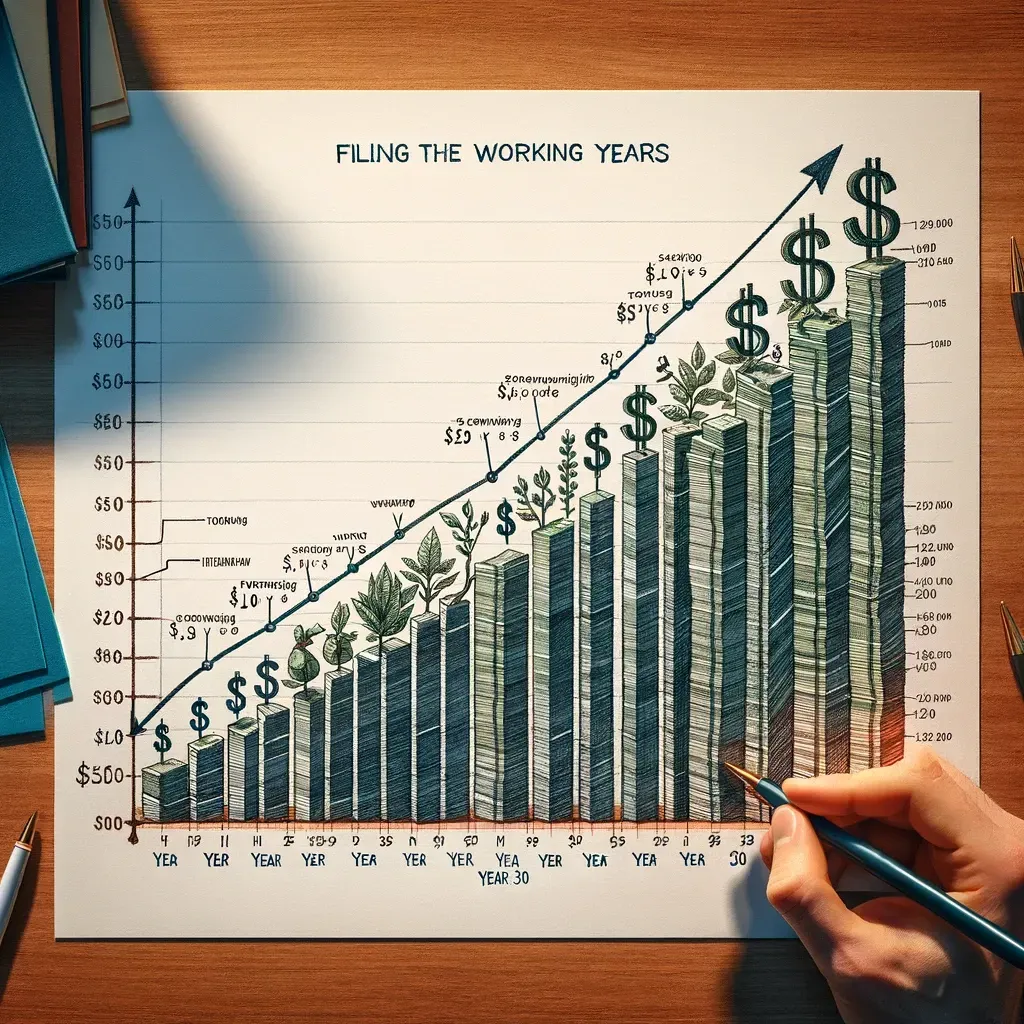

You Need to Fill-in

the Major Gap!

Between your Working Years

& NO Living-Cost-Adjustment!

The Vital Need for a 403(b) plan?

Traditional Pensions Lack Cost of Living Adjustments (COLA).

A 403(b) plan is not just a "want" but a "need."

It Safeguards Against Inflation

Ensuring a Secure Retirement.

Meet Jason’s 403(b) Needs!

Jason, a retired teacher with a fixed $57,000 annual pension.

Inflation over 20 years erodes the purchasing power of his pension.

His $4,600 yearly property tax becomes a burden.

Enter the 403(b) Plan: A vital savings tool.

Jason uses his 403(b) savings to supplement his pension.

Key Message:

A 403(b) plan is essential, especially in areas with non-COLA pensions.

It secures retirees like Jason against the impact of inflation, ensuring financial stability in retirement.

What is a 403(b) plan?

It is an IRS Code Designed Specifically for:

Employer-sponsored retirement plan

Public School Employees & Nonprofits

Key Benefits:

Tax Savings: Pre-tax contributions

Tax-Deferred Growth: Maximize returns

Diverse Investments: Customize your Portfolio

Expert Guidance: Personalized advice

How much can I contribute?

Generally, the lesser of

— 100% of includible compensation, or

— $23,000 contribution amount for 2024Your district may allow

$26,000 if eligible for 15 years of service catch-up (2024)

$30,500 if eligible for age 50 or older catch-up (2024)

Your employer may also contribute aggregate limits for multiple plans

Accessing Money in your 403(b) Plan

Withdrawals from a 403(b) plan may not begin before

Age 59½

Separation from service

Exceptions: certain hardships (if allowed by plan) or in cases of disability or death of employee

10% federal penalty tax for early withdrawal

Taxes are payable when money is withdrawn

Why participate in a 403(b) plan?

Pre-tax salary contributions reduce current taxable income

Convenient payroll reduction

Help better prepare yourself for retirement

Many people experience substantial changes in their income and expenses both when they retire and in the following years.

CONTRIBUTION COMPARISON

INCOME

GROSS PAY

403b Deduction/Pay

FED TAX / Pay

FED TAX %

NET PAY

AFTER TAX

WITHOUT 403b

$1,000

$0.00

$1,000

20%

$760.00

$0.00

WITH 403b

$1,000

$200

$800

20%

$608.00

$152.00

How do I start?

Obtain information about your 403(b) plan

Answer a Few Questions Using this

Fill out the Salary Reduction Agreement

Submit the Form & Complete Account Agreement

If you wish to schedule a calendar appointment, kindly click the button below.

Contact Us

Reach out to us for any queries or assistance regarding state workers' benefits and pensions.

© 2024 State Workers Benefits | All Rights Reserved