Roth IRAs

A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement.

Roth IRAs

A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement.

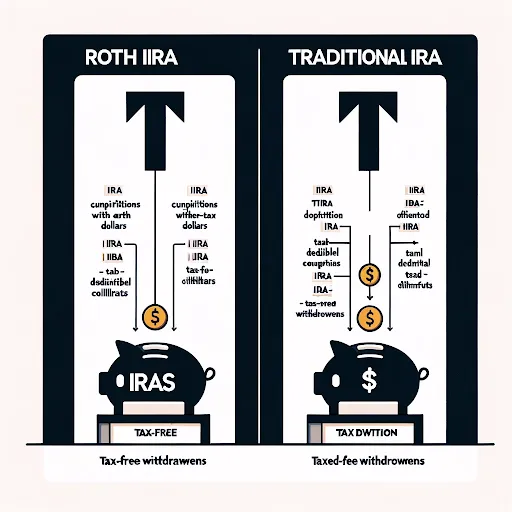

Roth v. Traditional

Unlike traditional IRAs, where contributions may be tax-deductible but withdrawals are taxed, Roth IRAs allow your investments to grow tax-free, with no taxes on withdrawals if certain conditions are met.

Roth v. Traditional

Unlike traditional IRAs, where contributions may be tax-deductible but withdrawals are taxed, Roth IRAs allow your investments to grow tax-free, with no taxes on withdrawals if certain conditions are met.

Eligibility Criteria

To contribute to a Roth IRA, your income must be within certain limits, which vary based on your tax filing status. These limits are adjusted annually by the IRS.

Eligibility Criteria

To contribute to a Roth IRA, your income must be within certain limits, which vary based on your tax filing status. These limits are adjusted annually by the IRS.

Contributions

The maximum annual contribution to a Roth IRA is $7,000 for those under 50 and $8,000 for those 50 or older (as of the current tax year). Contributions can be made up until the tax filing deadline for that year.

Contributions

The maximum annual contribution to a Roth IRA is $7,000 for those under 50 and $8,000 for those 50 or older (as of the current tax year). Contributions can be made up until the tax filing deadline for that year.

Tax Advantages

Roth IRAs offer significant tax advantages, including tax-free growth of your investments and tax-free withdrawals in retirement.

This can result in substantial savings over the long term.

Withdrawal Rules

Withdrawals from a Roth IRA are tax-free and penalty-free if taken after age 59½ and the account has been open for at least five years. Earlier withdrawals may be subject to taxes and penalties, with some exceptions for qualified expenses.

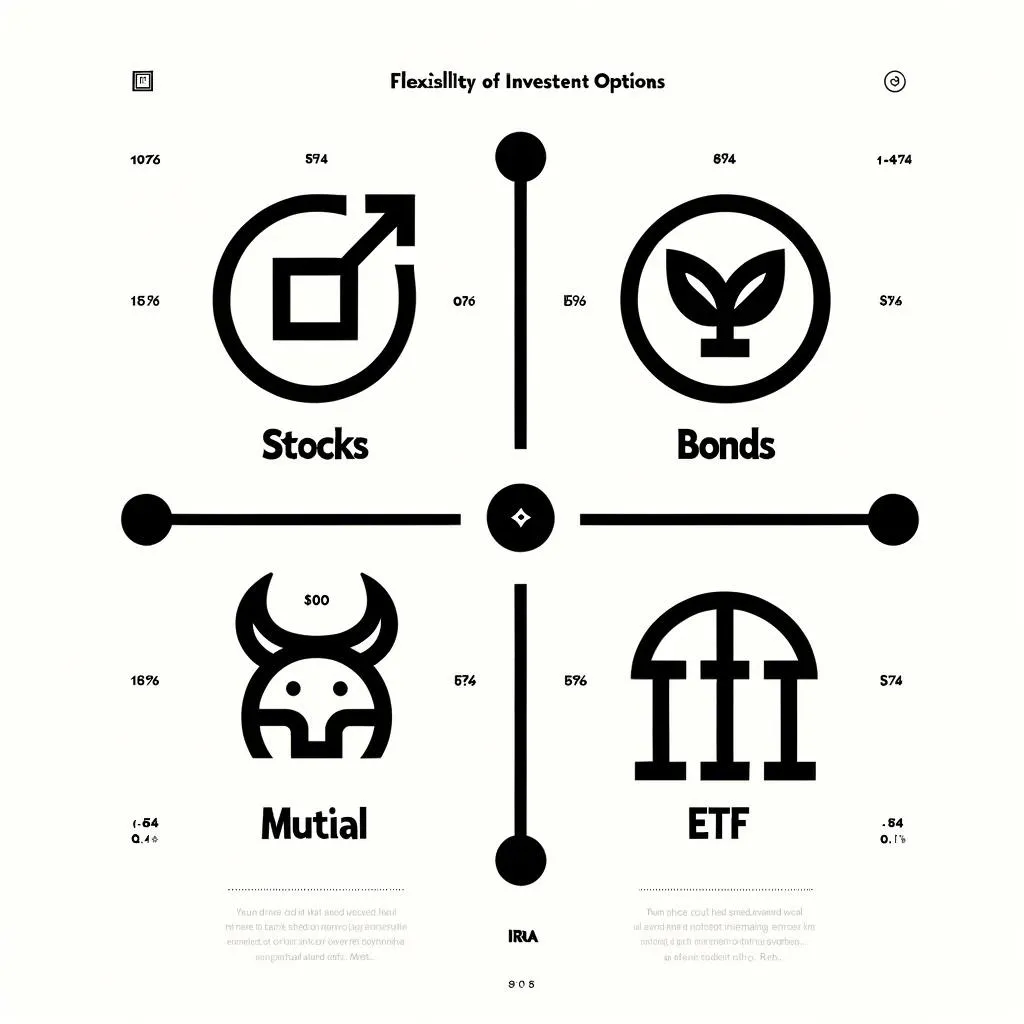

Investment Options

Roth IRAs allow a wide range of investment options, including stocks, bonds, mutual funds, and ETFs, providing the flexibility to tailor your investment strategy to your risk tolerance and retirement goals.

Roth IRA vs. Traditional IRA

Roth IRAs differ from Traditional IRAs primarily in how they are taxed. Contributions to Roth IRAs are made with after-tax dollars and can be withdrawn tax-free in retirement, whereas Traditional IRA contributions may be tax-deductible, but withdrawals are taxed as income.

Tax Advantages

Roth IRAs offer significant tax advantages, including tax-free growth of your investments and tax-free withdrawals in retirement.

This can result in substantial savings over the long term.

Withdrawal Rules

Withdrawals from a Roth IRA are tax-free and penalty-free if taken after age 59½ and the account has been open for at least five years. Earlier withdrawals may be subject to taxes and penalties, with some exceptions for qualified expenses.

Investment Options

Roth IRAs allow a wide range of investment options, including stocks, bonds, mutual funds, and ETFs, providing the flexibility to tailor your investment strategy to your risk tolerance and retirement goals.

Roth IRA vs. Traditional IRA

Roth IRAs differ from Traditional IRAs primarily in how they are taxed. Contributions to Roth IRAs are made with after-tax dollars and can be withdrawn tax-free in retirement, whereas Traditional IRA contributions may be tax-deductible, but withdrawals are taxed as income.

OPEN A ROTH IRA

OPEN A ROTH IRA

Our Services

PENSION:

Understand Your Retirement

-Challenge: Do you know when you can retire with a full pension?

-Solution: Understand how your pension works and find out your retirement date.

PERSONAL DEVELOPMENT : Educational Workshops

-Challenge: Is Your Family Safe from Life's Uncertainties?

-Solution: Shield Their Tomorrow with Comprehensive Life Insurance

-Act Now: Ensure Their Security Today

ESTATE PLANNING: Safeguarding Your Legacy

-Challenge: How will you ensure your wishes are honored?

-Solution: Create a solid estate plan with a Will & Testament, Trusts, and Health Care Directives.

Our Services

PENSION:

Understand Your Retirement

-Challenge: Do you know when you can retire with a full pension?

-Solution: Understand how your pension works and find out your retirement date.

PERSONAL DEVELOPMENT : Educational Workshops

-Challenge: Is Your Family Safe from Life's Uncertainties?

-Solution: Shield Their Tomorrow with Comprehensive Life Insurance

-Act Now: Ensure Their Security Today

ESTATE PLANNING: Safeguarding Your Legacy

-Challenge: How will you ensure your wishes are honored?

-Solution: Create a solid estate plan with a Will & Testament, Trusts, and Health Care Directives.

What are Sate Workers Saying...

"The information provided here has been invaluable in planning my retirement. I now feel more prepared and secure about my future."

Stephen Escobar

Educator

"As a firefighter, understanding my benefits and pension plan was crucial. This website made it easy and clear."

Gerald Nordstrom

Firefighter

What are Sate Workers Saying...

"The information provided here has been invaluable in planning my retirement. I now feel more prepared and secure about my future."

Stephen Escobar

Educator

"As a firefighter, understanding my benefits and pension plan was crucial. This website made it easy and clear."

Gerald Nordstrom

Firefighter

Contact Us

Reach out to us for any queries or assistance regarding state workers' benefits and pensions.

© 2024 State Workers Benefits | All Rights Reserved

© 2024 State Workers Benefits | All Rights Reserved